One Home Insurance Claim Can Cause Your Premium to Jump by 32%

A new study finds that filing a single claim on your home insurance policy could result in a hefty rate increase.

For the second year in a row, insuranceQuotes.com commissioned a Quadrant Information Services study that examined the average economic impact of filing a single claim on your homeowners insurance policy.

However, these increases are going to depend on many factors, including where you live and what type of claim you file.

If you file a home insurance claim, how much will your premium go up?

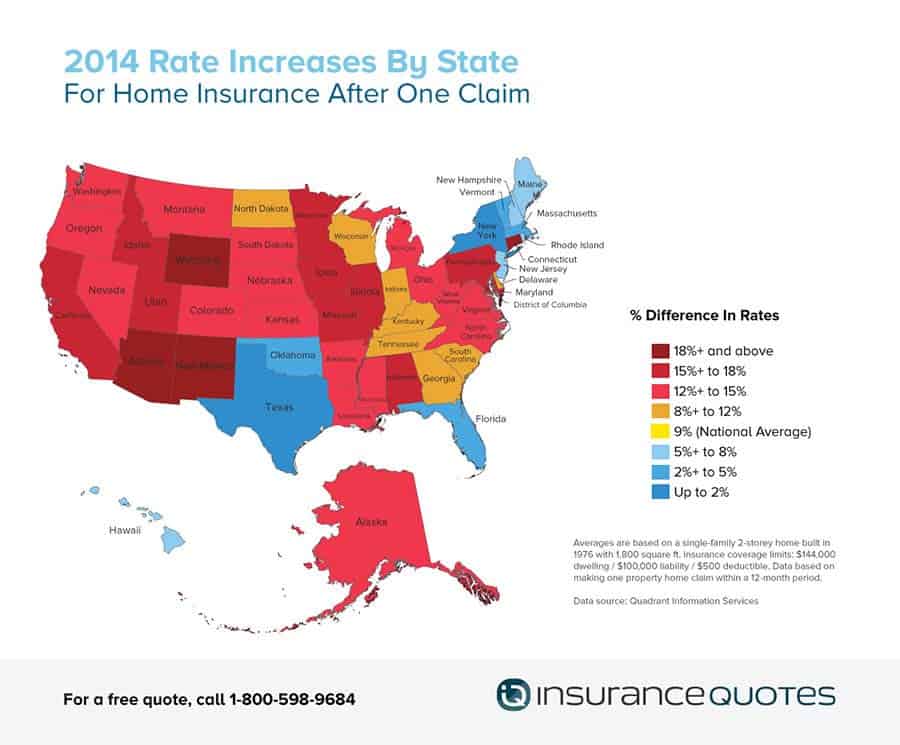

According to the study, U.S. families who file a single homeowners insurance claim can expect their annual premium to increase 9 percent (up from last year’s 8 percent). However, there are several states that buck the national average.

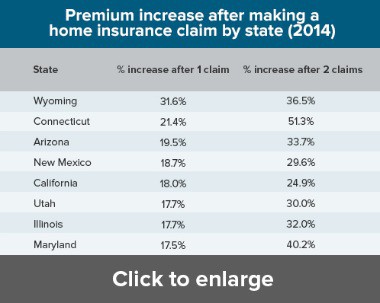

For instance, homeowners who file a single claim in Wyoming can expect their annual premium to increase by 32 percent on average.

However, filing a single claim in Texas won’t result in any premium increase.

According to the study, premiums in 37 states plus Washington, D.C., increased by an average of 10 percent or more after filing a single claim.

There are multiple factors that can cause home insurance rates to go up or down, according to Chris Hackett, director of personal lines policy at the Property Casualty Insurers Association of America, an insurance trade association. These factors include:

- New companies may start writing policies in a state, while others may stop.

- Different states face different risks and claim types.

Donna Tommelleo, spokeswoman for the Connecticut Insurance Department, says that from late 2010 to early 2013, Connecticut was hit by several natural disasters resulting in five federal disaster declarations.

Those events included two of the worst winters on record, resulting in hundreds of roof collapses; Tropical Storm Irene; and a freak nor’easter on the heels of Superstorm Sandy.

As a result, Connecticut insurers have adjusted their rates to compensate for three years of extremely expensive claims.

Why do premiums increase after filing just one claim?

Hackett says homeowner premiums may be increased after a single claim for one simple reason.

“There’s a significant statistical correlation between making a claim and the likelihood of making an additional claim in the future,” Hackett says. “Insurers need to adjust the cost of insurance to compensate for that increased risk.”

But according to Amy Bach, executive director of the California-based nonprofit consumer advocacy group United Policyholders, this rationale doesn’t hold water.

“(There’s a general feeling that) it’s completely unfair that an insurance company is free to raise your rates because you had the gall to actually use your insurance,” Bach says.

To that end, some states are beginning to tighten regulations on how insurers can raise premiums as a result of filing a single claim.

David Nardecchia, manager of the commercial property and casualty division at the Texas Department of Insurance, says Texas insurance law prohibits insurers from increasing premiums on homeowners for filing first-time claims.

This explains why there is no premium increase after filing a first-time claim in Texas.

Interesting changes from last year’s study

One of the most interesting findings of this study was the fact that some states’ average premium increases fluctuated significantly from the 2013 findings.

For instance, filing a single claim in Wyoming in 2013 resulted in an average premium increase of 15 percent. This year, however, it jumped to 32 percent, the most significant year-over-year spike.

However, filing a single claim in Minnesota in 2013 resulted in an average premium increase of 21 percent (the highest that year). In 2014, however, the increase was down to 16 percent.

“Our premium numbers are heavily dependent on weather trends, and that may play a role,” says Mark Kulda, spokesman for the Insurance Federation of Minnesota.

Since 1998, Minnesota experienced an unprecedented uptick in natural disasters, including 144 tornadoes in 2010. As a result, insurers increased premiums more dramatically after a claim to make up for the increased costs.

However, Kulda speculates that Minnesota home insurance premiums may be catching up to weather-related claims of the past decade – which may explain Minnesota’s ranking drop.

How the cost of home insurance affects premium increases

According to James Lynch, chief actuary and director of research and information services for the nonprofit Insurance Information Institute, it’s important to consider the actual cost of home insurance when examining the result of filing a single claim.

For instance, according to a 2013 study conducted by the National Association of Insurance Commissioners’ (NAIC), the average cost of home insurance in Florida is $1,933 per year, the highest of all 50 states.

So a 3 percent increase for filing a single claim is going to result in homeowners paying about $60 more per year.

However, according to the NAIC, the average cost of home insurance in Wyoming is just $770.

So a 32 percent increase for filing a single claim is going to result in a $246 annual premium spike, bringing the premium up to $1,016 – which is still significantly lower than Florida’s average premium cost.

“(Wyoming residents who make a claim) may pay an additional $250, but if that’s the result of an insurance company settling a $7,000 claim for you, insurance is still a good proposition,” Lynch says.

How the type of claim affects home insurance premiums

Not all claims are created equal, and the type of claim you file could significantly affect how your premium is impacted.

Hackett says that this is because certain claims, like medical, are typically less expensive than others.

“The policy limits for medical expenses tend to be on the lower end, like around $5,000. But the limits on liability can be $300,000 or more,” Hackett says.

Here’s a ranking of the average premium increases you can expect from filing various types of insurance claims:

- Liability — 14 percent increase

- Fire — 13 percent increase

- Theft — 13 percent increase

- Vandalism — 13 percent increase

- Water — 12 percent increase

- Hail — 6 percent increase

- Wind — 6 percent increase

- Medical — 2 percent increase

- Weather — 2 percent increase

Note: Percentages have been rounded.

How to save money on your homeowners insurance

No matter where you live, here are four tips to help you save money on homeowners insurance.

1. Get a higher deductible.

“We always encourage consumers to get a higher deductible,” Bach says. “The higher your deductible the lower your premium is going to be.

However, there’s a caveat: Before raising your deductible, you should consider how much out-of-pocket money you can afford if you need to file a claim.

2. Your home insurance is not a maintenance policy.

Your roof may be old, and you know that a windstorm is eventually going to blow it off. It’s better to budget for replacing the roof on your own than it is to submit a claim after the damage occurs, Bach says.

3. Find out if filing a claim will raise your rates.

“Ask your agent: ‘How much will my rate go up if I file one or more claims? And does it matter how far apart they occur?’ Write down the answers and keep them with your insurance policy for future reference,” Bach says.

If your agent can’t answer these questions, Bach says you should keep digging until you find someone who can.

4. Ask your agent about discounts.

According to Hackett, there are myriad discounts available to homeowners, many of which go unnoticed.

For instance, if you set up an automatic payment through your checking account online or bundle your home and auto policies with the same insurer, you may be awarded a discount.

Hackett adds that many insurance companies are also starting to provide discounts of 15 to 20 percent if a home is equipped with a 24/7 security system.

If you need help comparing insurance policies from multiple providers, our licensed agents at iQ can help you.

Methodology: Averages are based on a single-family, 1,800 square feet, 2-storey home built in 1976 with the following insurance coverage limits: $144,000 dwelling / $100,000 liability/ $500 deductible. Data based on making one home insurance claim within a 12-month period.