If You Have Poor Credit You May Pay Nearly Double for Home Insurance

Your credit history plays into many of your financial transactions, and a new study has found that it can play a significant role in what you pay for homeowners insurance.

A July 2014 Quadrant Information Services study, commissioned by insuranceQuotes.com, examined the average impact your credit-based insurance score has on what you pay for home insurance.

The study found that if you have a fair (i.e., median) credit score, you may pay 29 percent more for home insurance on average than someone with excellent credit.

But if you have poor credit rather than excellent credit, your premium nearly doubles — your rate may increase by an average of 91 percent.

To learn more, click here to download a free consumer resource, Insurance Rates and Your Credit: What Every Consumer Should Know.

Moreover, many consumers aren’t even aware their credit history is being used this way in most states. According to a 2007 survey conducted by consumer advocacy organization Consumer Federation of America, just 57 percent of people surveyed were aware their credit score could affect what they pay for home insurance.

Here are ways insurers use credit history and how you can improve your score and potentially pay less for home insurance.

What’s a credit-based insurance score?

According to Lamont Boyd, insurance underwriting expert at FICO, your credit-based insurance score is derived from a combination of factors in your credit reports and is used to help insurers better determine the likelihood you will file a future claim.

According to FICO, about 95 percent of auto insurers and 85 percent of home insurers use credit-based insurance scores in states where it’s allowed.

Only California, Maryland and Massachusetts ban the use of credit in setting insurance rates.

Boyd says insurers started using credit-based insurance scoring in the early 1990s when FICO conducted studies with insurers that showed a statistical correlation between a person’s credit and his or her likelihood of filing an insurance claim.

“We know that the way someone manages his or her credit correlates very strongly to whether or not they will have a future homeowner loss,” Boyd says.

Your credit-based insurance report is created using financial data collected by the major credit bureaus like Equifax or TransUnion. The data may include:

- Outstanding debt.

- Length of credit history.

- Late payments.

- Collections.

- Bankruptcies.

- New applications for credit.

According to Boyd, about 35 percent of your credit score hinges on whether you pay debts on time.

The second most impactful factor, Boyd says, has to do with how much debt you owe compared to how much you are allowed to borrow. This accounts for about 30 percent of the scoring model, so the closer you are to being maxed out on your credit cards, the more negatively it will impact your score.

How is a credit-based insurance score used to determine home insurance premiums?

What’s tricky about credit-based insurance scores is there’s no standardization in how insurers use them. Where one insurer may weigh your score very heavily, another may not consider it to be as important in setting a premium.

It’s also important to understand that unlike a traditional credit score (which is used by lenders such as credit card issuers), consumers don’t have access to their credit-based insurance reports. And this creates another problem.

According to Amy Bach, executive director of San Francisco-based nonprofit United Policyholders, insurance companies are very guarded about how they use credit-based insurance scores to set rates, which makes it extremely difficult for consumers to determine how their credit affects what they pay for insurance.

“Getting an answer to that question requires some really hard digging,” Bach says. “So if you’re comparison-shopping, it’s almost impossible to find an apples-to-apples relationship between your credit score and what you’re going to pay for insurance.”

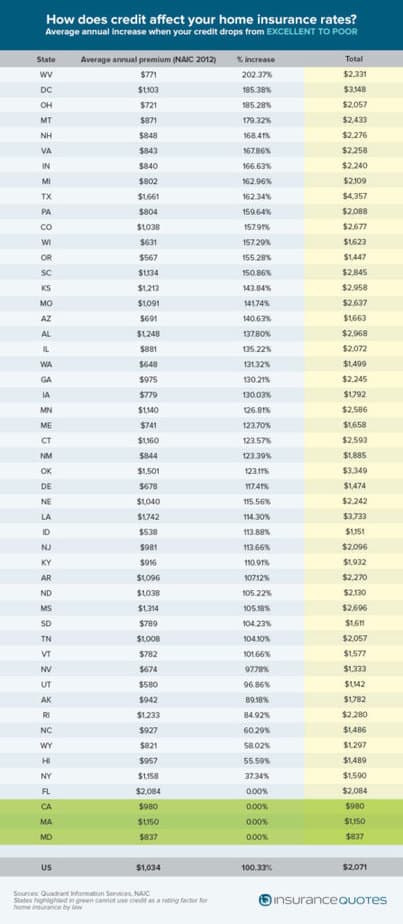

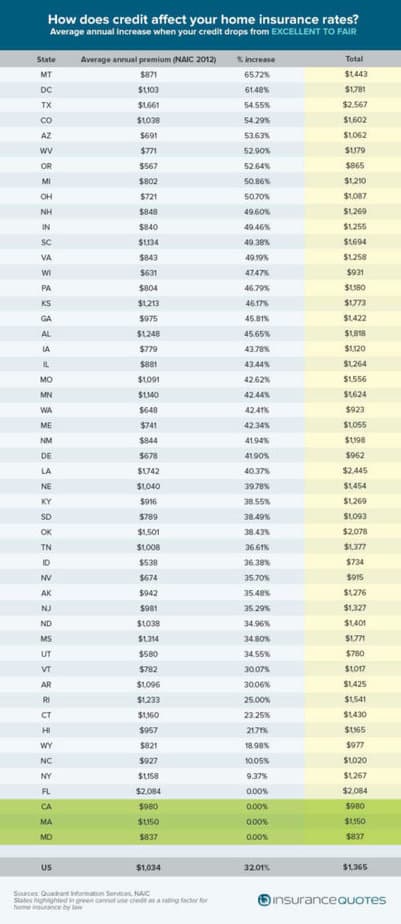

Credit-based insurance scores and home insurance by state

In our study, we reviewed three tiers of credit: excellent, fair and poor. How these tiers impact your insurance premium varies widely from state to state.

The following five states showed the greatest average premium increase if your excellent credit is downgraded to fair.

1. Montana — 65 percent increase

2. Washington, D.C. — 60 percent

3. Arizona — 55 percent

4. West Virginia — 53 percent

5. Virginia — 52 percent

Excluding Maryland, Massachusetts and California, the following five states showed the smallest percentage increase.

1. Florida — 0 percent increase

2. Hawaii — 6 percent

3. New York — 11 percent

4. North Carolina — 13 percent

5. Wyoming — 18 percent

“I’m pretty shocked that even with a so-called fair credit score, you could still wind up paying 50 percent more than someone in the excellent category,” says Bob Hunter, former Texas insurance commissioner and current director of insurance at the Washington, D.C.-based Consumer Federation of America.

The premium increase you see when your credit drops from excellent to poor is even more dramatic. Here are the top five states with the biggest increases.

1. West Virginia — 208 percent increase

2. Virginia — 186 percent

3. Ohio — 185 percent

4. Washington, D.C. — 182 percent

5. Montana — 176 percent

Excluding Maryland, Massachusetts and California, the following five states, on average, showed the smallest percentage premium increase.

1. Florida — 0 percent increase

2. Hawaii — 15 percent increase

3. New York — 43 percent

4. Wyoming — 53 percent

5. North Carolina — 74 percent

According to Mike Barry, spokesman for nonprofit Insurance Information Institute, the reasons behind these state differences is straightforward.

“For one thing, not all insurers write policies in every state,” Barry says. “So an insurer that heavily weighs (credit-based insurance scores) in one state might not write policies in another. And secondly, insurers may find that credit scores make a bigger difference in some states as opposed to others.”

In Boyd’s opinion, these state-by-state differences indicate “the competitive nature of the insurance marketplace.”

In other words, insurance companies in certain states may weigh credit-based insurance scores less heavily in order to be more competitive with pricing.

“Insurance companies want to write as much business as they can, and it’s clear to me that in certain states, such as Hawaii, they may want to be more careful about how they price various risks,” Boyd says.

How home insurance rates are set in Florida

If you live in Maryland, Massachusetts or California, your credit score doesn’t influence your home insurance rate because all three states ban the use of credit-based insurance scores in determining premiums.

Florida has no ban written into law; yet, the study shows credit makes no difference in what residents pay for home insurance.

According to Harvey Bennett, spokesman for Florida’s Office of Insurance Regulation, this is probably because most insurers in Florida choose not to use credit-based insurance scores when pricing policies.

“Florida law allows companies to use credit history,” Bennett says. But, he adds, most don’t

According to Jordan Holmes, a commercial and personal lines agent for the Florida-based Darr Schackow Insurance agency, insuring property in Florida is already very expensive because of frequent tropical storms and hurricanes.

In fact, according to a December 2013 NAIC homeowners report, homeowners insurance in Florida is now twice as expensive as the national average, making it the most costly state for home insurance in the nation.

“Insurers here already have to charge so much for insuring a home that personal credit rarely comes into play,” Holmes says.

Opponents of credit-based insurance scoring

Since its inception, credit-based insurance scoring has come under attack by many critics who feel using someone’s credit history to determine risk is unfair and irrelevant.

Bach says credit scoring primarily hurts low- to moderate-income earners, since they are the ones with typically lower credit scores.

And while she admits there may be a statistically relevant connection between credit score and risk, she says that the practice should be universally banned because it “punishes people for factors often beyond their control.”

In Bach’s opinion, credit-based insurance scores are just a proxy for income and that since insurance companies typically prefer wealthier clients, using credit as a rating factor may allow insurers to charge economically disadvantaged consumers more for insurance.

How to improve your credit-based insurance score

There are ways you can improve your credit-based insurance score the same way you can boost your regular credit score. A few tips include:

- Pay all of your credit card debts and installment loans on time.

- Don’t open any new credit accounts unless it’s an absolute necessity.

- Keep credit card balances as low as possible — ideally about 25 percent of your available credit limit.

- Shop around. Barry says, “If you find that your credit score is rising but your premium doesn’t fall, that means it’s time to shop around for another home insurer, because you can probably find a more affordable policy.”

Methodology:

insuranceQuotes.com commissioned Quadrant Information Services to calculate home insurance rates using data from 6 major carriers with approximately 60% market share in each state. The averages are based on a 40-year-old single woman who owns a 2-story single family home, built in 1978, with $144,000 dwelling coverage, $100,000 liability coverage and a $500 deductible. The three tiers of credit-based insurance scores analyzed were excellent, fair and poor.